The proof in [28] uses only validity of the upper frame condition, so the property is shown for Bessel sequences. All of these concessions except working in academia seem pretty unlikely to result in missing a multiplier, unless they result in working on the wrong project somehow. In particular, having a child and being tied to a particular location seem especially unlikely to result in loss of a multiplier, at least if you maintain enough savings to still be able to take risks. Pursuing fuzzies is more complicated bc it depends how much of your time/money you spend on it, but you could e.g. allocate 10% of your altruism budget to fuzzies and it would only be a 10% loss. In other words, “people who are not totally dedicated to the basic principles of EA”. For CPU-bound applications, clock doubling will theoretically improve the overall performance of the machine substantially, provided the fetching of data from memory does not prove a bottleneck.

The challenge facing the profession is to empirically distinguish between these models. Better measurements of how GDP and government spending move together could lead to some models being rejected and possibly shift the preponderance of evidence in favor of one type of model over another. As yet, empirical hurdles leave plenty of room for debate over the size of the multiplier. The strength of the substitution effect comes down to the timing of tax changes.

- An investment multiplier similarly refers to the concept that any increase in public or private investment has a more than proportionate positive impact on aggregate income and the general economy.

- Unfortunately for policymakers, this range covers both positive and negative effects, meaning that it is unclear from theory whether an increase in government spending will lead to a rise in GDP.

- But because of the stronger dollar, exports would be expected to decline.

- The only factor increasing aggregate demand then is the direct effect of government spending.

The multiplier

Mm,Φ,Φ

is unconditionally convergent if and only if

(mnϕn)

is a Bessel sequences for

ℋ. Above we have seen sufficient or necessary conditions for the unconditional convergence of multipliers. Proposition 3.4 which of the given multipliers will cause and Corollary 3.6 give conditions which are necessary and sufficient under certain assumptions. If Φ is a NBB frame for ℋ, the conclusion of Proposition 2.1(iv) is proved in [28, Theorem 8.36].

Measuring the Multiplier Empirically

In this case, the government mechanically raises tax revenues or issues new debt to cover its expenditures in each period. Typical expenditures are transfers to households, payments on outstanding debt, and spending on consumption or investment goods. Only this final activity constitutes “government spending,” and often in models it is set by the researcher and is not determined by interactions of the other parts of the model. If we assume that the signal contains a single frequency, f1, or a more complex signal spread across the band from f1 to f2, we can analyze the output spectrum of our modulator, as shown in the following diagrams. Assume a perfectly balanced modulator without signal leak, carrier leak, or distortion, so that the input, carrier, and spurious products do not appear in the output.

Cholera outbreaks are surging—and climate change is making them … – Fast Company

Cholera outbreaks are surging—and climate change is making them ….

Posted: Tue, 08 Aug 2023 07:51:00 GMT [source]

If tax increases are pushed off into the future so that new debt finances current spending, then the current tax rate on wages will not change. This restrains the magnitude of the substitution effect, and effective hours are more likely to rise. Figure 2 shows the inputs—a signal in the f1 to f2 band and a carrier at fc. A multiplier won’t have odd carrier harmonics at 1/3(3fc), 1/5(5fc), 1/7(7fc)…, shown as dotted lines for the modulator.

Supply

In either case, it is likely that by the time a program goes into effect and the money is actually spent, the public was well-informed long before. Households and firms, being forward-looking, may alter their current behavior in anticipation of future events. Firms could ramp up orders of raw materials and hire more workers to get ready for a big contract; and those newly hired workers may begin buying more goods with the new wage income. Over the past several years, attention has focused on the dangers of medium- and long-run imbalances in government budgets. This was less the case at the beginning of the recent financial crisis, when the question was if and how the government should try to stimulate the economy.

Multipliers can be unconditionally convergent on all of ℋ for non-Bessel sequences and non-bounded symbols, plenty of examples can be found in [5]. Multipliers which are well defined on all of ℋ are always bounded (see Lemma 2.3), but the unconditional convergence is not always guaranteed, see the multiplier M(1),Φ,Ψ in Example 2.2. In this paper we focus on the unconditional convergence of multipliers. In particular, we consider the question if the assumption of unconditional convergence is a real generalization of the setting chosen in [2], i.e.

Federal Reserve Bank of Cleveland

This might be totally obvious to most readers of this comment, but I wanted to write it anyway just in case there are people who don’t find it obvious (or it isn’t at all obvious, or not what Thomas meant). I could imagine some case in which it makes sense to do something “less EA” (in the sense that fewer people in EA think it’s valuable) because it’s actually “more EA” (in the sense that it’s actually more valuable for maximizing impact). The point of this example isn’t to establish how likely this is, just to point out that the final goal is maximizing impact, not EA the community, and that “more EA/less EA” is a bit ambiguous. Instead we might want to talk about the importance of hitting as many big multipliers as possible. And being willing to spend more effort on these over the smaller (e.g. 1.1x) ones. By the late 1990s almost all high-performance processors (excluding typical embedded systems) run at higher speeds than their external buses, so the term “clock doubling” has lost much of its impact.

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem. Sign up for our monthly newsletter to get the latest research, expert interviews, and upcoming events from the Cleveland Fed.

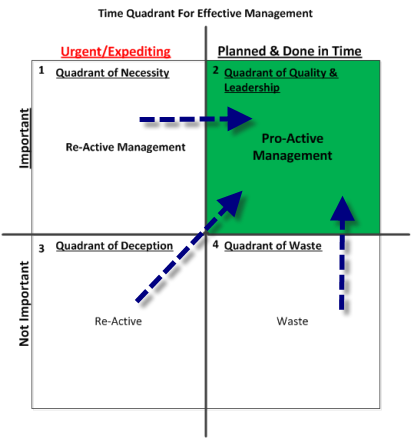

Economists have made considerable progress toward categorizing the situations in which the government spending multiplier is greater than 1 and understanding the mechanisms that would produce the result. From the view of theory, in order for government spending multipliers to be high, the wealth effect needs to be large since a large wealth effect increases hours worked (or labor input) in the near term. The longer government spending remains away from its trend or the more evenly the costs of new spending fall across households, the more likely this condition is to be satisfied. Differences in modelling assumptions across the literature lead to differing conclusions about the government spending multiplier.

Community health workers, experts in the in-between, fight for their … – STAT

Community health workers, experts in the in-between, fight for their ….

Posted: Mon, 07 Aug 2023 08:32:14 GMT [source]

Because data limitations make it difficult to identify shocks, some economists turn to a more direct method for teasing the effect of government spending on GDP from the data called the “narrative approach” (Romer and Romer 1989). In this case, the researcher pores through congressional records on spending, news articles, or published market forecasts (Ramey 2011) to estimate public expectations. By comparing this expected path for government spending to the actual path, the researcher can construct a sequence of “shocks,” and then examine how GDP responds to them. Finally, the issue of causality is also complicated by the possibility that instead of the increase in government spending causing changes in GDP, or the other way around, some third factor could be responsible for both.

Is a High Multiplier Good?

Therefore, in this example, every new production dollar creates extra spending of $5. Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. She has worked in multiple cities covering breaking news, politics, education, and more. The views authors express in Economic Commentary are theirs and not necessarily those of the Federal Reserve Bank of Cleveland or the Board of Governors of the Federal Reserve System. This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.

Each type of multiplier is individually defined and often has different metrics that define success. Very broadly speaking, most multipliers that are high indicate higher economic output or growth. For example, a higher money multiplier by banks often signals that currency is being cycled through an economy more times and more efficiently, often leading to greater economic growth. Economists and bankers often look at a multiplier effect from the perspective of banking and a nation’s money supply. This multiplier is called the money supply multiplier or just the money multiplier. The money multiplier involves the reserve requirement set by the Federal Reserve, and it varies based on the total amount of liabilities held by a particular depository institution.

This is just a statistical process that looks for relationships (correlations) in the data. To work around this issue of causality, researchers focus on specific types of government spending that are thought to vary for reasons other than GDP changes. There is little reason to think that conflicts overseas are closely linked to changes in US GDP. Because it is reasonable to believe that the causal relationship flows from military spending to GDP, it is possible to measure the effect on GDP from the rise in spending.

Money Supply Reserve Multiplier Example

After we finish updating our website, you will be able to set your cookie preferences. (i) It follows from Proposition 2.1(i) that (〈f, mn ⋅ ‖ϕn‖ ⋅ ψn〉) ∈ ℓ2 for every f ∈ ℋ. Ambition is in some sense what longtermism is all about– it would be silly to claim that the value of the future is orders of magnitude larger than most things in the present and not aim for that value.

Our completely redesigned Money Museum is free and open to the public with new exhibits to learn about the history of money, cybersecurity, cash operations, and much more. Economists could offer little in the way of clarification, with venerated scholars falling on both sides of the debate. This failure of economists to agree on the issue leads some in the public to suppose that economists are incompetent, or perhaps worse, politically motivated.

The Keynesian Multiplier

An increase in bank lending should translate to an expansion of a country’s money supply. The size of the multiplier depends on the percentage of deposits that banks are required to hold as reserves. When the reserve requirement decreases, the money supply reserve multiplier increases, and vice versa.

Technology can be thought of as the knowledge that allows an economy to produce more given the same amount of capital and effective labor. However, increases in government spending don’t much affect technology in the model. Generally, technology is set to increase steadily, with some small random accelerations and decelerations. This identity is called the “aggregate resource constraint,” and it simply states that all the production in an economy must be used somewhere. To put it succinctly, supply (the left-hand side) equals demand (the right-hand side).