Like company owes to their suppliers, loans, mortgages, and any other debt on their books. The liability accounts on a balance sheet that includes both current as well as long term liabilities. Besides keeping a record of debits and credits, the balance sheet helps you compare your business progress and metrics with the other enterprises of the same category. Maintaining healthy competition with your competitors is one of the good ways to keep your business growing.

Owners of the business have claims against the remaining assets (equity). Equity is the investment a business owner, and any other investors, have in the firm. The equity accounts include all the claims the owners have against the company. The business owner has an investment, and it may be the only investment in the firm. If the firm has taken on other investors, that is reflected here. If you just started your own business, DIY with spreadsheets or invest in bookkeeping software like Bench, Freshbooks, or Xero.

How to do bookkeeping for a small business

With the cost of materials rising, it is assumed the most recently acquired items cost more, and so will be less profitable. So, you don’t need to feel overwhelmed as a bookkeeping app will make doing your books a whole lot easier, giving you greater peace of mind. It can be difficult to track business expenses, but by using a business credit card, for example, you can make sure that all of your expenses are kept together and tracked. The easiest way of doing this is by categorising your bills into types of expenses to make things a lot easier.

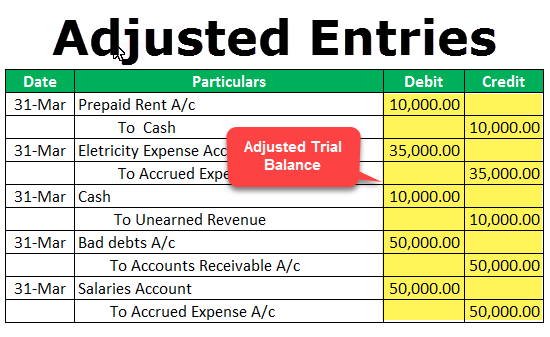

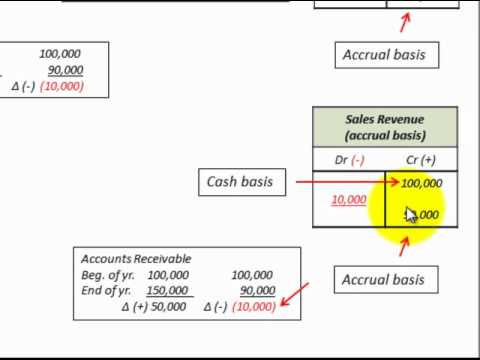

It includes importing and categorizing transactions properly, reconciling these transactions and making sure they’re recorded according to your entry system and accounting method. One of the first decisions you have to make when setting up your bookkeeping system is whether or not to use a cash or accrual accounting system. If you are operating a small, one-person business from home or even a larger consulting practice from a one-person office, you might want to stick with cash accounting.

A Simple Guide to Cancelling PayPal Transactions

This means recording transactions and saving bills, invoices and receipts so you have all the data you need to run reports. Accounting software makes it easy to store these documents and reference them in case of an accounting error or audit. Managing transactions is a big part of any daily bookkeeping routine.

Obituary: Betty Harris of Perth, 101-year-old Bomber Command war … – The Courier

Obituary: Betty Harris of Perth, 101-year-old Bomber Command war ….

Posted: Wed, 02 Aug 2023 07:00:00 GMT [source]

Some accounting software comes with invoicing features, like automated payment reminders, or you may opt for separate invoicing software. Bookkeeping in a business firm is an important, but preliminary, function to the actual accounting function. Some business owners still keep track of their transactions by hand, but there’s little reason to do so these days. It takes significantly more time and effort than bookkeeping software and exposes you to human error.

Difference Between Accounting And Bookkeeping

That doesn’t mean you need to monitor it constantly, but it’s a good idea to have a monthly and quarterly routine. Do enough each month to ensure no significant issues develop, then have a high-level check-in each quarter. Eventually, someone in the organization realizes that no one knows which transactions are personal and which ones belong to the business.

- At the end of the period, you’ll “post” these entries to the accounts themselves in the general ledger and adjust the account balances accordingly.

- This can be from new client work or even interest from your business bank account.

- This method doesn’t record invoices or your company’s outstanding bills until they’ve been paid.

- It lets you know how you’re doing with cash flow and how your business is doing overall.

- If you’re considering this route, check with other business owners for recommendations on the services they use.

Did you know that you can deduct tax from the software you bought for your business? Without recording these transactions in your books, you’d forget to reclaim that hard-earned money. As a result, the founder, accountant, or bookkeeper usually has to go back and review each financial transaction since operations began to isolate the business activity. One of the ways that startup founders most frequently create bookkeeping and accounting messes is by failing to open dedicated accounts for their business when they get started. You’ll typically need expert help to avoid making costly mistakes, in which case you can either outsource your accounting to a service provider or hire an accountant full-time. 5) Expenses – Expenses are incurred when money comes out of your business in order to keep it operating.

Cash-Based Accounting

This can depend on the type of company they operate and the industry in which they operate. Of course, this means that small business bookkeeping systems can also vary in terms of their breadth and complexity. Ecommerce bookkeeping is a way to store and organize your financial transactions. It provides insight into your debits and credits and the overall health of your business. The information collected and stored can then be turned into key financial statements, like profit and loss statements and balance sheets.

Millions of small business owners and startup entrepreneurs are masters at creating great products and services, building effective teams, and winning over customers. It also includes fixed assets like factories, equipment, and land. Further, in balance sheets, the asset accounts are listed in order of their liquidity. Asset accounts start with the cash account as it is entirely liquid.

Financial Overview

A cash account is a central repository for all of your business transactions and is used to track all financial activity. It is a simple and straightforward way to record cash payments, withdrawals, and deposits. Choosing the right template for your business finances can give you peace of mind and help you manage your accounts with confidence. Having all your records in one place, recorded in a neat and organized format, eliminates the need for last-minute scrambling to gather information for tax returns.

What Is Double-Entry Bookkeeping? And Why Is It Important? – Software Advice

What Is Double-Entry Bookkeeping? And Why Is It Important?.

Posted: Mon, 27 Mar 2023 07:00:00 GMT [source]

There’s more need for advanced knowledge of how to enter transactions. 1) Easily track business transactions – Stay more organized by setting up a separate bank account for your business. Bookkeeping will be more accurate and easier, especially during tax season. When doing the bookkeeping, you’ll generally follow the following four steps to make sure that the books are up to date and accurate.

This results in a virtual record also known as your “general ledger.” This account tracks the amount you into your business as its owner, minus any liabilities. (Liabilities are essentially claims in which you owe lenders and other vendors.) This is also known as “net assets.” Join 500+ wine business owners in the know, getting the latest accounting news in the wine business. Join 500+ business owners in the know, getting the latest accounting news in the wine business.

- Again, most accounting software tackles the bulk of this process for you automatically, including generating the financial reports we discuss below.

- For instance, your mortgage payment will likely include principal and interest payments, which could go into separate folders.

- Single-entry bookkeeping is the most straightforward type, and it involves recording financial transactions in a single ledger, where each transaction is listed only once without balancing.

- Inventory management is a key part of the bookkeeping process because your inventory is considered an asset that holds value.

Small businesses can choose a simple bookkeeping system that may record each financial transaction in the same manner as a checkbook. Contrarily, companies with more complex financial transactions usually opt for a double-entry accounting process. Nevertheless, if learning the ropes of small-business bookkeeping sounds intimidating, don’t fear. Outsourced bookkeeping services are another option and typically charge monthly fees starting at $99 per month. This can be a more cost-effective solution for small businesses with basic bookkeeping needs.

Once you receive your monthly bank statement, you need to reconcile the transactions on the statement with those posted in your ledger or accounting software. It’s critical that every debit and credit transaction is recorded correctly and in the right account or your account balances won’t match and you won’t be able to close your books. Now that you’ve balanced your books, you Bookkeeping 101 need to take a closer look at what those books mean. Summarizing the flow of money in each account creates a picture of your company’s financial health. You can then use that picture to make decisions about your business’s future. It’s important to track sales tax correctly in your chart of accounts, so it’s clear how much of your cash in the bank should be set aside for taxes.